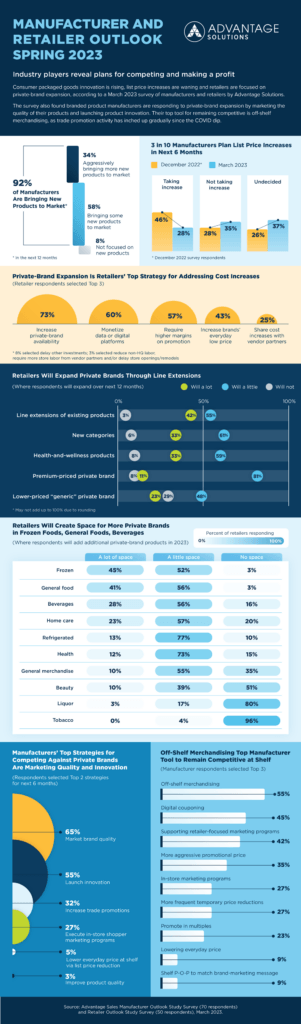

Consumer packaged goods innovation is rising, list price increases are waning and retailers are focused on private-brand expansion, according to a March 2023 survey of manufacturers and retailers by Advantage Solutions.

The survey found that branded product manufacturers are responding to private-brand expansion by marketing the quality of their products and launching product innovation. Their top tool for remaining competitive is off-shelf merchandising, as trade promotion activity has inched up gradually since the COVID dip.

“Manufacturer and Retailer Outlook: Spring 2023,” based on 120 responses to surveys by consumer goods manufacturers and grocery retailers, found that most retailers are addressing cost increases by increasing private-brand availability (73% named it a Top 3 strategy). They plan to expand private brands through a variety of measures over the next 12 months, with retailers saying they will focus particularly on the following steps: line extensions of existing products (42%), introducing private brands to new categories (33%) and adding private-brand products to their health-and-wellness mix (33%).

Branded CPG manufacturers’ top strategies for competing with private brands include marketing their brands’ quality, cited by two-thirds of respondents as a Top 2 strategy, launching innovation (55%) and increasing trade promotions (32%).

The survey also found:

- Nine in 10 manufacturers are bringing new products to market in the next 12 months, with one-third of those “aggressively” bringing these products to market.

- In addition to increasing private brand availability, retailers’ top strategies for addressing cost increases include monetizing data or digital platforms (60% named it a Top 3 strategy), requiring higher margins on promotions (57%) and increasing brands’ everyday low prices (43%).

- Retailers will create space for more private brands, particularly in the frozen food, general food and beverage categories. Nearly all retailers surveyed (97%) say they will add some space for private-brand frozen food and general food.

- Off-shelf merchandising is manufacturers’ top tool for remaining competitive at shelf, cited by more than half (55%) of survey respondents as a Top 3 strategy, followed by digital couponing (45%) and supporting retailer-focused marketing programs (42%).