Nearly half of surveyed manufacturers will increase their list prices in the first six months of 2023."

When it comes to price increases, trade spending, product assortment and fill rates, consumer packaged goods manufacturers’ and retailers’ strategies, plans and expectations don’t always align, according to a recent survey of industry players by Advantage Solutions.

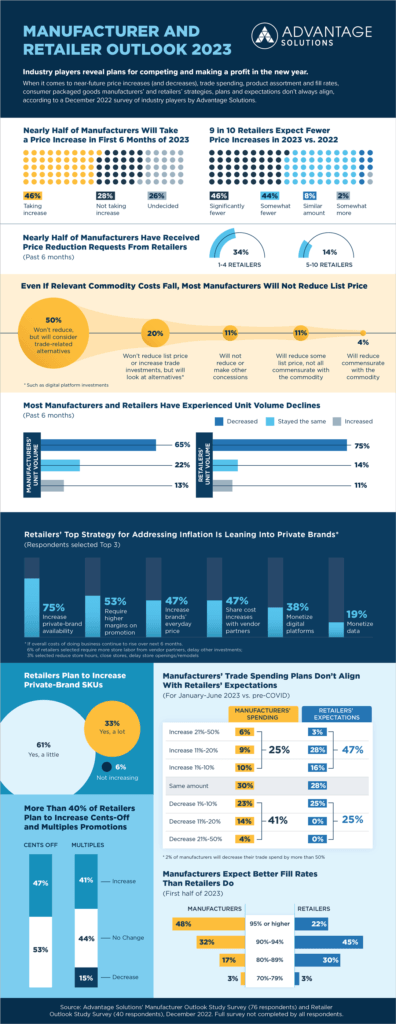

“Manufacturer and Retailer Outlook: January 2023,” based on more than 100 responses to surveys by consumer goods manufacturers and grocery retailers, found nearly half (46%) of surveyed manufacturers will increase their list prices in the first six months of 2023. More than one-fourth are still undecided.

At the same time, nine in 10 retailers expect fewer price increases this year compared to last year — nearly half expect “significantly fewer.” Just 2% of surveyed retailers expect somewhat more price increases; 8% expect a similar amount.

As consumers contend with rising shelf prices and downsized packaging, nearly half (48%) of manufacturers have received at least one retailer request for a list price reduction. Fourteen percent report receiving requests from five to 10 retailers.

Still, even if the cost of commodities related to their products falls, eight in 10 grocery manufacturers say they will not reduce their list prices. However, half will consider bumping up trade spending and another 20% will consider other alternatives such as investing in digital platforms. Only 4% say they’ll reduce their list price by an amount commensurate with commodities.

“On some subjects, grocery product manufacturers and retailers have dissimilar points of view and expectations and it’s critical to understanding those differences so that both can approach business conversations knowing where opportunities for mutual benefit and closer alignment exist,” said Jill Blanchard, president, client solutions for Advantage Solutions. “As consumer behavior and the marketplace evolves, manufacturers and retailers will always find areas where their individual goals align.”

The survey also found:

- Most manufacturers (65%) and retailers (75%) experienced a decline in unit volume in the past six months.

- Retailers’ top strategy for addressing inflation over the next six months is leaning into private brands by increasing their availability — 94% said they will be doing this in 2023 and a full one-third plan to increase their store brand availability “a lot” in 2023. Addressing shoppers’ inflation-fueled price sensitivity, nearly half of retailers plan to increase the use of cents-off promotions and four in 10 will offer more discounts on multiple-item purchases.

- Manufacturers’ plans for trade spending for the first half of the year don’t align with retailers’ expectations. Compared to pre-COVID levels, just 25% of manufacturers say they’ll increase their spending, while 47% of retailers expect to see increases.

- Nearly three years into COVID-ignited supply-chain challenges, manufacturers are much more optimistic than retailers about fill rates for the first half of 2023. Nearly half of product manufacturers predict fill rates of at least 95%, while just 22% of retailers do.